401k rmd calculator

Determine your required retirement account withdrawals after age 72 Retirement Income Calculator. Required Minimum Distribution RMD Calculator.

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

The SECURE Act of 2019 changed the age that RMDs must begin.

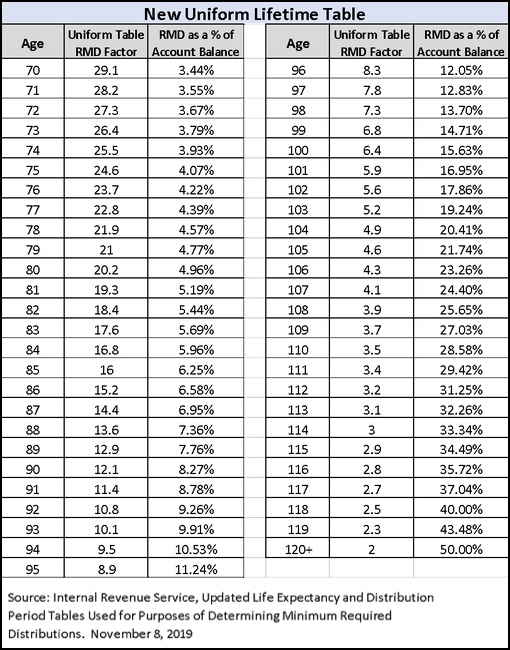

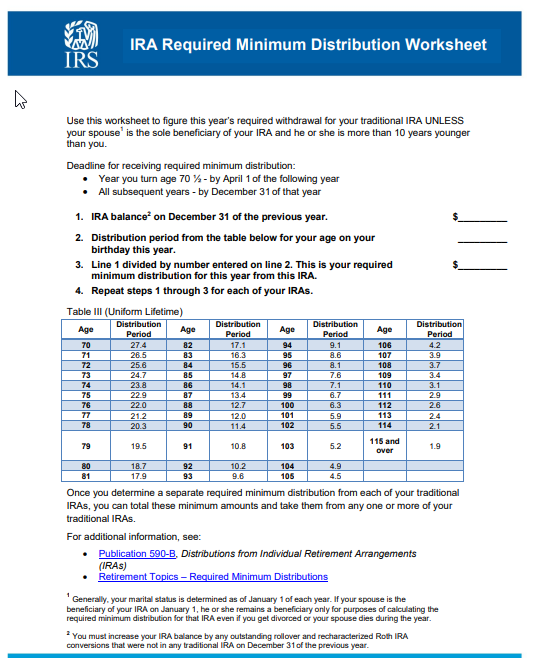

. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Get a quick estimate of how much. The first will still have to be taken by April 1.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from. Required Minimum Distribution Calculator. Westend61 GettyImages.

Ad Compare 2022s Best Gold IRAs from Top Providers. Schwab Has 247 Professional Guidance. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

The FINRA Required Minimum Distribution RMD from a traditional 401 k or IRA is based on your age and account value. For example if you turn 72 in October 2022. If you were born on June 30 1949 or earlier you were required to begin taking RMDs by April 1 following the year you reached age 70½.

Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Understand What is RMD and Why You Should Care About It. A 401 k can be one of your best tools for creating a secure retirement. For this example we will enter 72 as the age.

Schwab Can Help You Make A Smooth Job Transition. Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Dont Wait To Get Started. The second by December 31. Reviews Trusted by Over 45000000.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Calculate the required minimum distribution from an inherited IRA. Ad It Is Easy To Get Started. Account balance as of December 31 2021.

2022 Retirement RMD Calculator Important. You can use Vanguards RMD Calculator to estimate your future required distributions when youre putting together your retirement income plan. Use this calculator to determine your Required Minimum Distribution RMD.

You may also use the IRS. FINRA RMD Calculator. How is my RMD calculated.

First all contributions and earnings to your 401 k are tax deferred. Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. By pressing the calculate button we get two values.

As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. Starting the year you turn age 70-12. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Fidelity Investments - Retirement Plans Investing Brokerage Wealth. It provides you with two important advantages. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. You are retired and your 70th birthday was July 1 2019. Build Your Future With a Firm that has 85 Years of Investment Experience.

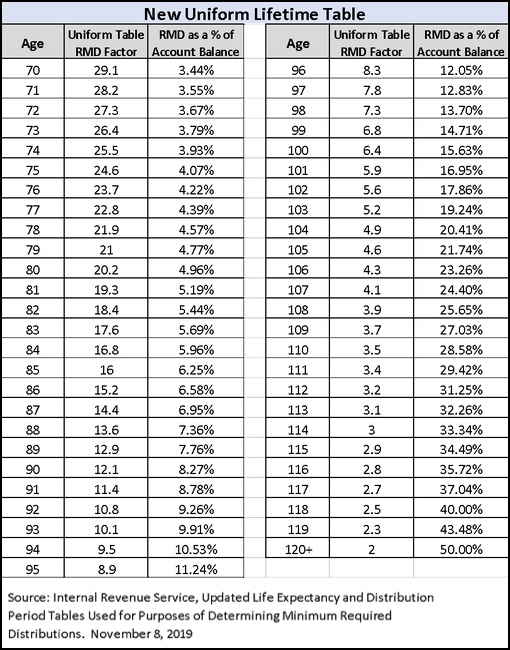

Your life expectancy factor is taken from the IRS. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. The calculator also asks you what your age was at the end of the last calendar year.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. If you were born. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Simplify Your 401k Rollover Decision. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. TIAA Can Help You Create A Retirement Plan For Your Future.

What Is A Required Minimum Distribution Taylor Hoffman

How Required Minimum Distributions Work Merriman

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Rmd Table Rules Requirements By Account Type

Rmd Table Rules Requirements By Account Type

Rmd Calculators India Dictionary

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

What Is A Required Minimum Distribution Taylor Hoffman

Required Minimum Distribution Calculator Estimate The Minimum Amount

Rmds An Irs Change Is Making Them Smaller In 2022

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Sjcomeup Com Rmd Distribution Table

How Are Required Minimum Distributions Rmds Calculated